Describe Who Issues Each of the Following Money Market Instruments

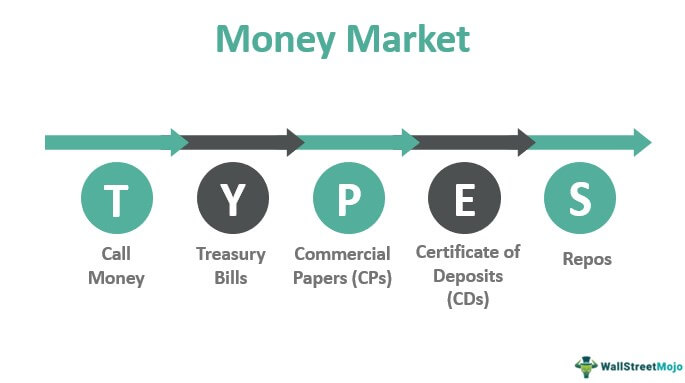

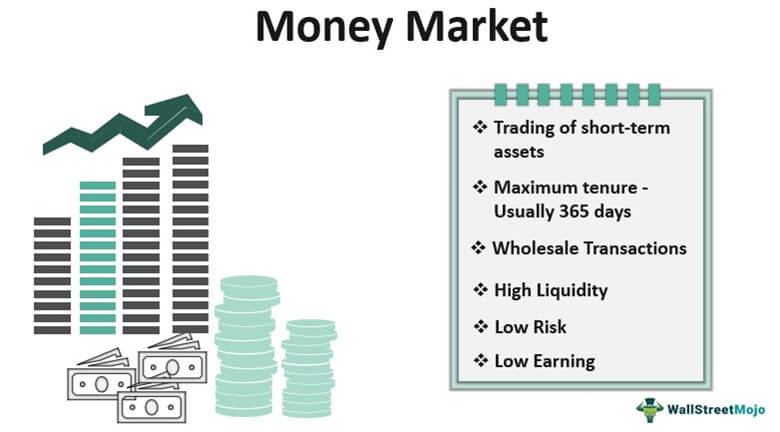

The money market is one of the two main segments of the Financial MarketIt performs the same functions of mobilizing funds in the economyHowever the one main factor of the money market is that it exclusively trades in financial instruments and commodities that have a term of less than one year. The money markets include the following different types of instruments each with different purposes.

Money Market Instruments Meaning Types Objectives Features

Some are designed for the use of banks and large financial institutions while others focus on businesses.

. Types of Money Market Instruments in India 1. These are shot um that instruments issued Bye. Describe who issues each of the following money market instruments.

Overnight funds-Central bank of a country 2. These can be of huge significance for companies looking to minimize their costs and Revenue maximization is the method of maximizing a companys sales by employing methods such as advertising sales promotion demos and test samples campaigns references. In addition money market instruments generally have the following two.

The money market is a market for short-term instruments that are close substitutes for money. Describe who issues each of the following money market instruments. Funds collected through such tools are used to meet short term requirements of the govt hence to.

Unsecured lending takes place through the federal funds market while secured lending occurs in the repo market. View the full answer. A Treasury bil 1 answer below 5.

Some of the instruments traded in the money market include Treasury bills certificates of deposit commercial paper federal funds bills of exchange and short-term mortgage-backed securities Mortgage-Backed Security MBS A Mortgage-backed Security MBS is a debt security that is collateralized by a mortgage or a collection of mortgages. It provides for the quick and dependable transfer of short term debt instruments maturing in one year or less which are used to finance the needs of consumers. They have varying short-term maturities.

The Government of India issues it at a discount for 14 days to 364 days. For each of the following money market instruments describe who issues the debt. Describe who issues each of the following money market instruments.

Because money was losing value at a slower rate the inflation rate was lower in the 1950s than in the 1970s it was. Helps in monetary policy. B Certificates of deposit.

Financial instruments must be appropriately taken into use to derive the most benefits. Describe who issues each of the following money market instruments. Who issues the following money market instruments.

For each of the following money market instruments describe who issues the debt. Treasury Bill Alright U. And to understand who issues that that we have to first understand what the instrument is for the U.

Some businesses may use an assortment of different money market accounts to cover their financial needs. This problem covers the concept of financial market instrument. Fed funds Treasury bills are short-term debt instruments issued by the United States government to.

There are 15 types of money market instruments. Money Market helps in financial mobility by allowing easy transfer of funds from one sector to another. This ensures transparency in the system.

Each meets the specific needs of different customers. Certificates of deposit-Banks and credit unions c. Money market instruments are short-term financing instruments aiming to increase the financial liquidity of businesses.

So first instrument is treasury belts. Money market instruments maturities can last from one day to one year with three months or less being the most common. Besides the money market deals are not out in money cash but other instruments like trade bills government papers promissory notes etc.

The money market and its instruments are usually traded over the. Certificates of Deposit. Certificates of deposit c.

A Treasury bills Treasury bills are short-term debt instruments issued by the United States government to cover immediate spending obligations ie. Seminar 1 Answers seminar nbs8018 international money and banking part some economists suspect that one of the reasons economies in developing countries grow so. Commercial Paper-Corporation and large banks d.

This is issued bye banks and salt two depositors. Banks lend to each other in what is called the interbank funding or lending market. The United Estates government to Kabul.

And well start with part a uh which the market instrument would be the U. It aims to capture a larger market. More important than primary market s.

Commercial banks primarily issue checkable deposits savings deposits and time deposits. The main characteristic of these kinds of securities is that they can be converted to cash with ease thereby preserving the cash requirements of an investor. E Fed funds 10 points 10 marks.

For each of the following money market instruments describe who issues the debt. Money market is a part of a larger financial market which consists of numerous smaller sub-markets like bill market acceptance market call money market etc. Immediate spending obligations that is finance deficit spending and the second is certificate of deposits.

Repurchase Agreement-Government of country e. Describe who issues each of the following money market instruments. High financial mobility is important for the overall growth of the economy by promoting industrial and commercial development.

Treasury Bills are one of the most popular money market instruments. Types of Money Market Instruments. Describe who issues each of the following money market instruments.

Treasury bills - Government b. Describe who issues each of the following money market instruments. Certificates of deposit c.

Money Market Instruments Shape The money market is the arena in which financial institutions make available to a broad range of borrowers and investors the opportunity to buy and sell various. The problem ask us to describe who issues the debt for the following money market instrument. Certificates of deposit.

The short term instruments are highly liquid easily marketable with little change of loss. Describe who issues each of the following moneymarket instrumentsa.

Money Market Definition Instruments Rates How It Works

No comments for "Describe Who Issues Each of the Following Money Market Instruments"

Post a Comment